Why is the Healthcare sector important in the Stock Market?

If we talk about the stock market, then the health care sector plays an important role in which a person can get both his development and stability. It ensures a very big place in itself, which contains pharmaceuticals, biotechnology , medical services and other health care services. The Healthcare sector is usually a good option for those investors who want to diversify their portfolio and reduce their risk potentially then they can think about investing in this sector.

Why healthcare?

Healthcare sector plays an important role in the portfolio of an investor in terms of economic and long -term investment. This sector is the most flexible area and also it has most important role in the stock market. There is always a demand for the health care sector due to medical services, pharmaceuticals and innovative treatments. Some important points are here to help you out why healthcare :

- Diversification

- Innovation and R&D

- Long-term Growth Potential

- Defensive Characteristics

- Essential Nature

Why is this Blog helpful for you?

The purpose of this blog is to provide information about healthcare stocks to investors so that they can make their decisions in investing in healthcare stocks and they can build their portfolio in this sector and can make better decisions.

Some of the options where you can check and build your portfolio:-

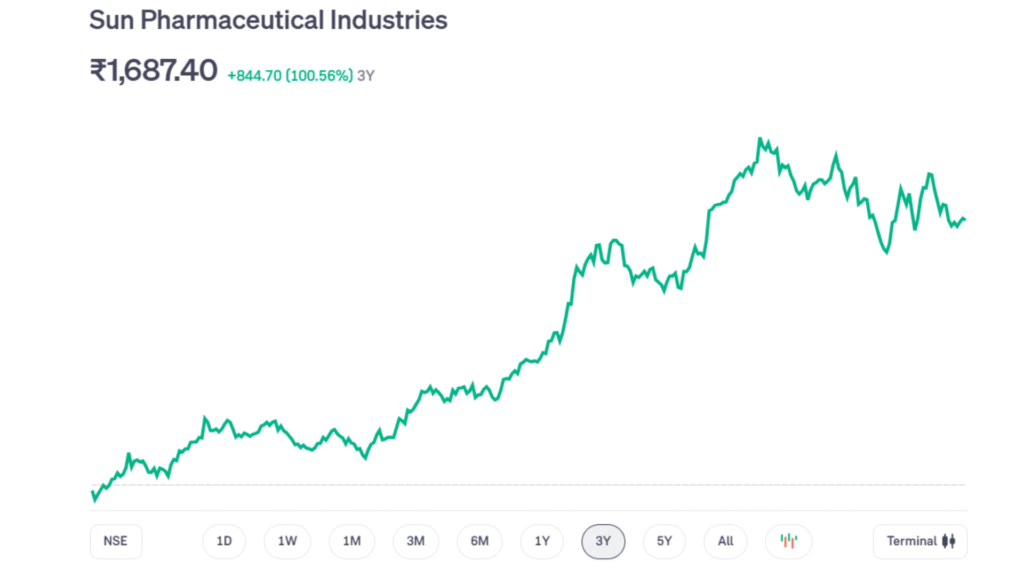

1. Sun Pharma

Sun Pharmaceutical Industries Limited is a leading Indian multinational pharmaceutical company specializing in generic and specialty medicines. It develops, manufactures, and markets a wide range of branded and generic drugs, including APIs, across 100+ countries, with a strong focus on dermatology, oncology, and chronic therapies.

Stock Price Growth – Share price surged from ₹450 (2020) to ₹1,800+ (2024), delivering strong multibagger returns.

Revenue Growth – Consolidated revenue grew from ₹33,489 Cr (FY20) to ₹49,887 Cr (FY24)

Record Profits in FY24 – Sun Pharma reported a robust ₹9,648 Cr net profit in FY2024, marking strong growth driven by its specialty drug portfolio and operational efficiencies in global markets.

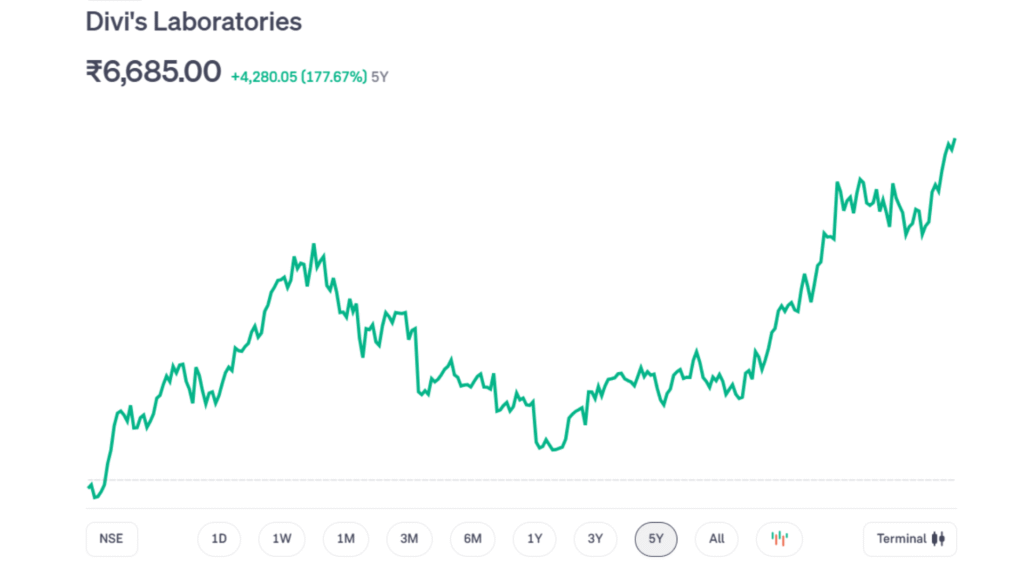

2. Divi’s Laboratories

Divi’s Laboratories is a leading Indian pharmaceutical company specializing in active pharmaceutical ingredients (APIs), intermediates, and custom synthesis solutions. Known for its expertise in complex chemistry, it supplies high-quality APIs for oncology, cardiology, and neurology to global markets. With US FDA and EMA-compliant facilities, strong R&D, and cost-efficient production, Divi’s is a trusted partner for generic and innovator drug manufacturers. The company maintains a strong reputation for quality, innovation, and sustainable growth in the pharmaceutical industry.

Stock Price Growth – Share price surged from ₹2800 (2023) to ₹6000+ (2024), delivering strong multibagger returns.

Revenue Growth – Consolidated revenue grew from ₹5,584Cr (FY20) to ₹8,184Cr (FY24)

Record Profits in FY24 – Sun Pharma reported a robust ₹1,600 Cr net profit in FY2024, marking strong growth driven by high-margin custom synthesis projects and cost efficiencies.

3. Lupin

Lupin is a top Indian pharmaceutical company with a global presence, known for its wide range of generics, branded drugs, APIs and biotech products. It has a strong foothold in the US, Europe and India, focusing on anti-infectives, cardiovascular, respiratory and diabetes treatments. With US FDA and EMA-approved facilities, Lupin emphasizes innovation, quality and compliance. Its strong R&D and strategic acquisitions make it a key player in the global pharma market.

Stock Price Growth – Lupin’s share price rose from around ₹650 (2023) to over ₹2,000+ (2024), showcasing significant multibagger returns driven by improved business performance and market optimism.

Revenue Growth – Consolidated revenue increased from ₹15,859 Cr (FY20) to ₹20,142 Cr (FY24), reflecting steady expansion across key markets and product segments.

Record Profits in FY24 – Lupin reported a strong net profit of ₹1,936 Cr in FY2024, fueled by higher margins in the US generics business, cost optimization and successful new product launches.

4. Cipla

Cipla is a top-tier Indian pharmaceutical company with a significant global footprint. It specializes in manufacturing generic drugs, APIs and innovative respiratory medications, with core strengths in anti-infectives and chronic therapies. The company operates US FDA and WHO-compliant manufacturing facilities worldwide. Known for its affordable healthcare solutions and patient-centric approach, Cipla has established itself as a trusted name in both developed and emerging markets through consistent quality and strong R&D.

Stock Price Growth – Cipla’s share price demonstrated remarkable growth, surging from ₹875 (2023) to ₹1,650+ (2024), reflecting strong market confidence in its business strategy.

Revenue Growth – The company grew revenue from ₹17,476 Cr (FY20) to ₹26,521 Cr (FY24)

Record Profits in FY24 – Cipla reported a net profit of ₹4,155 Cr in FY2024, driven by margin expansion, new product launches and operational efficiencies.

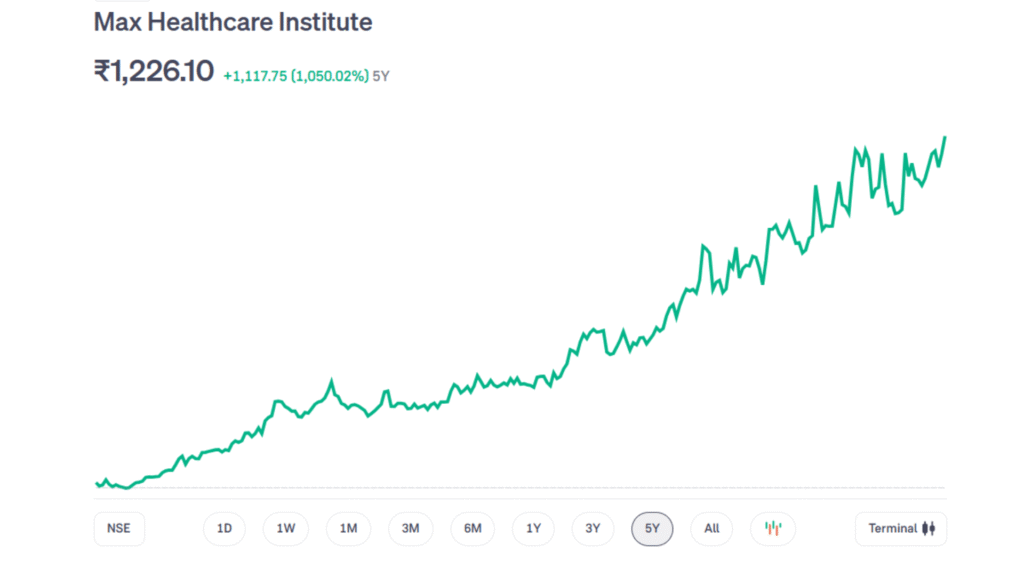

5. Max Healthcare

Max Healthcare Institute is a leading private healthcare network in India, known for its multi-specialty hospitals across North India. Headquartered in Delhi-NCR, the group offers comprehensive care with special strengths in oncology, cardiology, neurosciences and orthopedics. With 17 state-of-the-art facilities and over 3,400 beds, Max Healthcare combines latest medical technology with expert specialists to deliver outstanding patient outcomes. The network has international accreditations including JCI and NABH and is consistently ranked among India’s top hospital chains for clinical excellence and patient-centric services.

Stock Price Growth – Max Healthcare’s share price rose from ₹110 (2020) to ₹1,150+ (2024), giving 900% returns as investors recognized its leadership in premium healthcare.

Revenue Growth – Max Healthcare’s revenue grew from ₹1,957 crore in FY20 to ₹5,584 crore in FY24, with year-on-year growth across all therapeutic segments.

Record Profits in FY23 – The company reported a net profit of ₹1,104 Cr in FY2023, driven by ARPOB (Average Revenue Per Occupied Bed) and operational efficiencies.

Disclaimer

The content provided on this blog is for informational and educational purposes only and should not be construed as financial, investment, or trading advice. I am not a licensed financial advisor, and the opinions expressed here are my own, based on personal research and experience.

Stock market investments carry inherent risks, including the potential loss of capital. Past performance is not indicative of future results. Always conduct your own due diligence and consult a qualified financial professional before making any investment decisions.

I do not guarantee the accuracy, completeness, or reliability of any information shared on this blog. Any actions you take based on the content are strictly at your own risk. By reading this blog, you agree that I am not liable for any losses or damages arising from your investment choices.

“In the long run, the healthcare industry is not just a sector—it’s a necessity.” — Peter Lynch